Video Ad Tech Firm Unruly Smashes $43M Revenue Mark For 2014 After Record-Breaking Fourth Quarter

International expansion and launch of mobile video ad exchange lead to record revenues for video ad tech company

A record-breaking fourth quarter helped video ad technology company Unruly to generate over $43 million USD[1] annual revenue in 2014.

The programmatic video platform has seen a period of significant growth across the Group over the last 12 months, reporting $43m in revenue for the year ending 31 December, 2014[2]. Unruly reported $16m of revenue in Q4 2014, seeing growth of 40% from Q4 2013 to Q4 2014.

As well as the launch of new offices in Asia Pacific, 2014 saw a period of format innovation for Unruly, with its skippable pre-roll format, launched in May 2014, now accounting for 22% of total revenues. The October launch of UnrulyX™, the first supply side platform (SSP) for mobile video to guarantee viewability, has also contributed to revenue growth.

Unruly CEO and founder Scott Button said: “Our new In-Feed format, the first ad format to inject native video ads at scale into mobile news feeds, now allows advertisers and premium publishers to take advantage of the huge opportunity that mobile video offers. And as buying automation grows, we predict rapid revenue growth from UnrulyX, our mobile video ad exchange.

“As our programmatic ad technology has matured, we’ve reached an inflexion point in the business. Our rapid growth in 2014 has been entirely organic and our continuing investment in programmatic technology and proprietary data will fuel further revenue growth through the next 12 months and beyond.”

Video ad spend is expected to double between 2014 and 2018[3], continuing to fuel growth, along with the shift towards programmatic advertising, where global spend is projected to leap from $12 billion in 2013 to $32.6 billion by 2017[4].

Unruly also anticipates that more ad dollars shifting from TV to digital will fuel continuing growth. US ad spend on the Internet surpassed ad spend on broadcast television for the first time in 2013, increasing 17 per cent in 2013 to a record $42.8bn[5].

Mike Kelly, Chairman at Unruly, said: “It’s been an incredibly exciting year for Unruly. Our strategic decision to build a full programmatic stack and to expand into Asia Pacific is already paying off and has set us up for future growth. At a macro level, digital video is growing exponentially and the way in which advertising is being bought has changed forever. 2015 will see even more momentous growth as Unruly continues to deliver wow for more advertisers looking to take full advantage of the mobile video opportunity.”

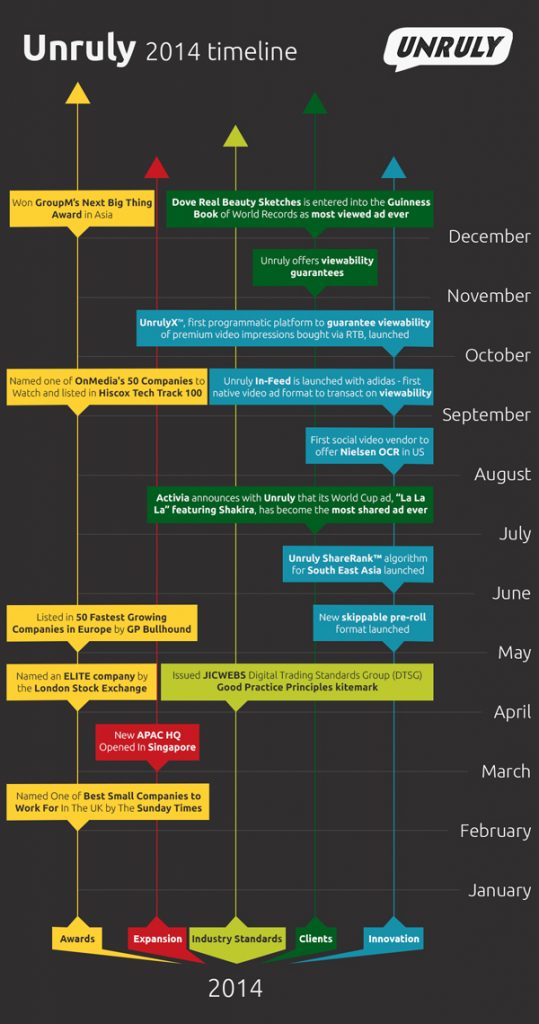

2014 saw the following milestones for the company:

- Expansion: Unruly opened an APAC HQ in Singapore, with new office openings planned for 2015. During 2014, Unruly’s headcount increased from 140 to 190. Unruly currently has 20+ new positions being advertised across its international offices;

- Awards: The Company received several prestigious awards during 2014. It featured in the Sunday Times’ Hiscox Tech Track 100, an annual ranking of the fastest-growing companies in the UK, was one of OnMedia’s 50 Companies to Watch in the US and was named the Next Big Thing at GroupM’s annual APAC Awards last month. The company was also named one of the The Sunday Times’ Best Companies to Work For.

- New products launched in 2014:

- UnrulyX™, the first programmatic media trading platform to guarantee the viewability of premium video impressions bought via RTB;

- Unruly’s skippable pre-roll format, which puts the viewer in control and gives advertisers cost-efficient reach at speed and scale;

- Unruly’s native in-feed format, the first ad format to deliver native video ads at scale across mobile newsfeeds.

*****************

UNRULY, UNRULYX and associated logos, designs and other marks are trademarks and/or registered trademarks of Unruly Group Limited in the United Kingdom, the United States of America and elsewhere. Other trademarks are owned by their respective owners.

We are Unruly

Video ad tech company Unruly is the leading programmatic platform for social video advertising, powered by UnrulyX, the first supply side platform (SSP) for mobile video to offer scaled delivery of native ad formats and guarantee the viewability of premium video impressions bought via RTB.

With 3 out of every 4 video views now taking place outside of YouTube, 84% of Ad Age 100 brands trust Unruly’s proprietary video stack to reach and engage custom audiences at speed and scale across the Open Web.

Differentiated by a unique data set comprising 1.3 trillion video views and analyzing 116 million shares per day, Unruly algorithmically predicts content shareability and programmatically targets custom audiences across video, mobile and native ad formats, with guaranteed viewability and brand safety across mobile, tablet and desktop devices to an audience of 1.27 billion monthly unique users.

Unruly employs 190 people across 13 offices in 10 countries, with regional HQs in London, New York and Singapore. As well as a number of accolades recognizing its technical innovation and product quality (Digiday, Sunday Times, Braves), the company has won ‘Best Companies to Work For’ (Sunday Times), ‘Best Digital Ad Ops Team’ (AOP) and has been named as the UK’s #2 Fastest Growing Tech Company (Deloitte). Its super power is unique data. Its secret weapon is passionate people on a mission to #DeliverWow.

Find out more at www.unruly2018.staging.wpengine.com

[1] Unruly reports its financials in GBP. For the purpose of this release, a 1.6 FX rate has been used to convert GBP to USD.

[2] Revenues reported are for the period of 1 January, 2014 to 31 December, 2014. All statements and estimates are made based on the information available to the Company’s management as of the date of publication, but no guarantee can be made as to their validity. These figures remain subject to audit. The Company does not undertake, and expressly disclaims, any duty to update these figures or other statements after the date of publication.

[5] Joint report from the Internet Advertising Bureau and PwC